What is the global trend of regional renewable energy investment over time?

Implementation of renewable energy into electric grids around the world will be key to curbing the effects of climate change. Currently, three quarters of global greenhouse gas emissions result from fossil fuel energy production (Ritchie, Roser, 2020). As put by the International Renewable Energy Agency (IRENA), “meeting international climate and development objectives will require a massive re-allocation of capital toward low-carbon technologies, including renewables, and the mobilization of all available capital sources”. In the past, renewable energy technologies such as solar and wind have been expensive forms of generating electricity but, over the last ten years there has been a steep decline in their costs. From 2009 to 2019 the price of electricity from solar power has dropped 89% and the wind has dropped 70% (Roser, 2020). It might seem obvious that renewable portfolios have been growing in recent years as governments and politicians advertise, however does data actually support this? How are investments in renewable technologies changing over time? How does this compare to investment in non-renewable energy?

As climate change becomes an ever more present and increasing threat, detecting these trends can tell us if the world is on the right track to reducing carbon emissions from energy generation. IRENA dives deep into these questions in its report, “Global Landscape of Renewable Energy Finance 2020” for the time period of 2013-2018. The IRENA report compares investment to climate goals like the Paris Agreement and makes recommendations on how these goals can be met more effectively. It also discusses the sources of the capital for energy projects and dives into off-grid renewable finance. The data used for the analysis in this blog post is from IRENA and the Climate Policy Initiative (CPI) and covers the time period of 2000-2020.

This blog post will take a more streamlined look at the general investment trend of global regions across time with linear regression models. Using a significance level of 0.05, I aim to detect whether the results from the models are statistically significant. This post is by no means a comprehensive study, however it will provide some quick insights. Some of the limitations of this analysis are discussed in the “Next Steps” section below.

Data

IRENA provides the data used in its 2020 finance report available for download from its website in an excel file format. To accompany the data, IRENA also posts a “methodology” document that discusses its sources and how its analysis was conducted. According to the methodology report, the data used in this blog post can be, “freely, used, shared, copied, reproduced, printed and/or stored.” It should be noted that all the data from my analysis in this post is from IRENA and they hold the copyright for it.

Financial data can be challenging to acquire and can cause some misclassifications of recipients however, IRENA has standardized this process to the greatest extent possible for these data. Private investment information can be particularly challenging to find and these date are primarily taken from the Bloomberg New Energy Finance database by IRENA. While, the data used in this analysis may not be comprehensive for all financial investment data, it is likely some of the most comprehensive that is freely available. The reported investment data are conservative according to the methodologies provided by IRENA to prevent “double-counts” as they state “under-reporting of renewable investments is preferred to over-reporting.” The methodology report also provides detailed information about data sources, regional breakdowns, and more. The IRENA 2020 report and its methodologies are fully referenced below.

The raw data from IRENA are broken down by individual project investments in renewable and non-renewable energy sources with the amount of the investment in million USD. For each individual investment there is a plethora of data available including the year, country, region, donor, technology, and more. The time frame of data available from this data is from 2000-2020 This blog post will use annualized totals of investment for global regions and therefore does not have a seasonal component. The countries represented in regional breakdowns were not determined by the author of this post and is directly embedded from these IRENA data.

Show code

# Make file path for the data

fp <- here("_posts/2021-11-23-detecting-trends-in-renewable-energy-investment/data/IRENA_RE_Public_Investment_July2021.xlsx")

# Read in the data using the readxl package

fin_energy <- read_excel(fp)

Show code

# Clean the data to remove fields that are not needed

fin_energy <- fin_energy %>%

clean_names()

# Remove unnecessary columns and the "multilateral" region

fin_energy <- fin_energy %>%

select(iso_code:region, year:technology, amount_2019_usd_million) %>%

filter(region != "Multilateral")

Show code

# Separate the data into the renewable and non-renewable investments

# The category section is kept to rejoin the data later to differentiate easily in a graph

renewable_fin <- fin_energy %>%

filter(category == "Renewables") %>%

group_by(country_area, region, category, year) %>%

summarise(country_sum = sum(amount_2019_usd_million))

non_renewable_fin <- fin_energy %>%

filter(category =="Non-renewables") %>%

group_by(country_area, region, category, year) %>%

summarise(country_sum = sum(amount_2019_usd_million))

Show code

# Make data frame for renewables for by region

region_renewable_fin <- renewable_fin %>%

group_by(region, category, year) %>%

summarise(region_sum = sum(country_sum))

# Make data frame for non-renewables for by region

region_non_renewable_fin <- non_renewable_fin %>%

group_by(region, category, year) %>%

summarise(region_sum = sum(country_sum))

# Make a data frame of the regional summations for graphing purposes later

full_region_fin <- full_join(x = region_renewable_fin,

y = region_non_renewable_fin)

Analysis Plan

First, a simple static time series model will explore the trend of the total annual amount invested in renewable energy by region across time. Regions are broken into Africa, Asia, Central America and the Caribbean, Eurasia, Europe, Middle East, Oceania, and South America. By running this simple model I aim to get a quick glimpse into the global trend of renewable investment over time, if one exists. This assumes that only the immediate year in question has an effect on the quantity of investment. This will then be compared to the trend in non-renewable energy source investment over the same time period. As previously mentioned, a significance level of 0.05 will be used to determine statistical significance. The null hypothesis for this first regression is that there is no relationship of annual renewable energy investment by regions over time.

Second, a more complex time series regression model will be produced where the primary simple regression model is broken up by regional heterogeneity to produce an interaction regression model. The first trend regression model provides a quick insight into how the world is investing as a whole based on regional sums for each year. However, it is evident with accords like The Paris Agreement it will take each country’s and region’s participation to minimize and eventually reverse the effects of climate change. With this in mind, the first regression model hides that certain regions are committing greater investments over time than other regions.

If regions are truly committed to curbing climate change the second regression model will show an overall positive trend. This evaluation will serve as a litmus test to observe regional commitment to global climate agreements. The same significance level will be used to test the null hypothesis that, within each region, there is no change of renewable investment rate over time. Finally, regional renewable trends will then be compared to their non-renewable counterparts.

Results

Simple Renewable Investment Trend Model

Below is the result of the regression model that tests the effect of

year on renewable investment. The output below is from the

summary() function, which quickly provides summary

statistics in R.

Show code

Call:

lm(formula = region_sum ~ year, data = region_renewable_fin)

Residuals:

Min 1Q Median 3Q Max

-2905.6 -1271.5 -523.4 486.5 11707.5

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -283692.95 53418.15 -5.311 3.13e-07 ***

year 141.88 26.58 5.339 2.73e-07 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 2167 on 184 degrees of freedom

Multiple R-squared: 0.1341, Adjusted R-squared: 0.1294

F-statistic: 28.5 on 1 and 184 DF, p-value: 2.735e-07Using the summary() function, we can quickly get some

insights from the regression model. From the output above the

coefficient estimate of the year tells us the annual rate of change of

investment with each increasing year for global regions. From the

regression model, this is 141.88 million USD. This tells us that,

according to this model, with each passing year we are seeing a increase

in renewable investment by 142,000,000 USD across each region per year.

Overall this is a positive trend for renewable investments year over

year.

From the summary() function the p-value is represented

in the “Coefficients” section of the table under “Pr(>|t|)”. The year

coefficient has a p-value below 0.001 which allows rejection of a null

hypothesis that there is no relationship between annual renewable

investment sums across time with a significance level of 0.05. It should

be noted that our R-squared value for this model is 0.13 however that is

not vital for this analysis as it is not focused on predicting outcomes

of investment with high precision, but rather the overall trend from the

year coefficient and its’ associated p-value.

With the information above, I believe the originally proposed question is answered and these data support that there is a positive rate of investment in renewable projects over time. Now lets compare that to non-renewables.

Simple Non-renewable Investment Trend Model

Show code

Call:

lm(formula = region_sum ~ year, data = region_non_renewable_fin)

Residuals:

Min 1Q Median 3Q Max

-2660.1 -1457.2 -796.8 -24.5 18677.7

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -218612.31 77728.01 -2.813 0.00549 **

year 109.54 38.67 2.833 0.00518 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 2974 on 170 degrees of freedom

Multiple R-squared: 0.04507, Adjusted R-squared: 0.03945

F-statistic: 8.023 on 1 and 170 DF, p-value: 0.005176From the summary() of this model, there is also a

positive trend of non-renewable investment across regions. There is an

annual increase in non-renewable investments by 109.54 million USD. With

a p-value of 0.005 a null hypothesis can be rejected that there is no

relationship between annual non-renewable investment over time with a

significance level of 0.05.

According to these two simple models, there is a larger increase in renewable investments year over year in this 20-year time period compared to non-renewables but as the standard errors for the models overlap this observation is not conclusive and this blog post will not be pursuing this question. Below is a plot that compares renewable and non-renewable investments over time, along with their respective models.

Show code

simple_model_plot <- ggplot(data = full_region_fin,

aes(x = year,

y = region_sum,

color = category)) +

geom_point(alpha = 0.8) +

scale_color_manual(name = "Energy Type",

values = c("tan3", "darkgreen")) +

geom_line(data = augment(model_renew),

aes( y = .fitted),

color = "darkgreen") +

geom_line(data = augment(model_non_renew),

aes( y = .fitted),

color = "tan3") +

labs(caption = "Renewable investments from 2000-2020 are increasing at a rate of 141 million USD per year according\nto this model. Non-renewable invesments over the same time period are increasing at a rate of\n110 million USD per year.",

title = "Comparing Investment Renewable and Non-renewable Energy\nInvestment Across Regional Sums") +

xlab(label = "Year") +

ylab(label = "Annual Regional Sum of Investment (million USD)") +

theme_bw() +

theme(plot.caption = element_text(hjust = 0))

simple_model_plot

It can be observed from the graph that there has been significant investment in renewable (green) and non-renewable (tan) energy projects since the 2008 global recession. The plot illustrates just how much variance there is in investment totals across regions in each year. As discussed above, the plot shows that there is a larger investment rate in renewables year-over-year. As this data is only from the years 2000-2020 these investment trends do not reflect the historical investments in non-renewable energy sources. As this simple regression only looks at the trend over time I will now investigate how these investment trends compare across separate regions.

Regional Renewable Investment Trend Model

For the regional renewable investment interaction regression model,

the same summary() function is used to calculate

coefficients and summary statistics. While the summary()

function is useful, its’ output can be quite messy with interaction

models; the table below is from the summary() results and

includes the annual investment rates for different regions and their

corresponding p-values. In the regression model, the North America

region was set as the base level of the regression. This was done

because North America contains the United States, the country with the

largest GDP in the world and therefore a significant marker to compare

against other regions.

Show code

# Make levels for regions with North America as first to compare our region to the rest of the world

region_renewable_fin$region <- factor(region_renewable_fin$region, levels = c("North America", "Africa", "Asia", "Central America and the Caribbean", "Eurasia", "Europe", "Middle East", "Oceania", "South America"))

# Make the regional investment model

region_model <- lm(region_sum ~ year + region + region:year, data = region_renewable_fin)

region_renew_model_summary <- summary(region_model)

Show code

# Making the results a summary table

summary_renew_region_table <- data.frame(Region = c("North America",

"Africa",

"Asia",

"Central America and the Caribbean",

"Eurasia",

"Europe",

"Middle East",

"Oceania",

"South America"),

Renewable_Investment = c(region_renew_model_summary$coefficients[2,"Estimate"],

region_renew_model_summary$coefficients[2,"Estimate"] + region_renew_model_summary$coefficients[11,"Estimate"],

region_renew_model_summary$coefficients[2,"Estimate"] + region_renew_model_summary$coefficients[12,"Estimate"],

region_renew_model_summary$coefficients[2,"Estimate"] + region_renew_model_summary$coefficients[13,"Estimate"],

region_renew_model_summary$coefficients[2,"Estimate"] + region_renew_model_summary$coefficients[14,"Estimate"],

region_renew_model_summary$coefficients[2,"Estimate"] + region_renew_model_summary$coefficients[15,"Estimate"],

region_renew_model_summary$coefficients[2,"Estimate"] + region_renew_model_summary$coefficients[16,"Estimate"],

region_renew_model_summary$coefficients[2,"Estimate"] + region_renew_model_summary$coefficients[17,"Estimate"],

region_renew_model_summary$coefficients[2,"Estimate"] + region_renew_model_summary$coefficients[18,"Estimate"]),

p_value = c(region_renew_model_summary$coefficients[2,"Pr(>|t|)"],

region_renew_model_summary$coefficients[11,"Pr(>|t|)"],

region_renew_model_summary$coefficients[12,"Pr(>|t|)"],

region_renew_model_summary$coefficients[13,"Pr(>|t|)"],

region_renew_model_summary$coefficients[14,"Pr(>|t|)"],

region_renew_model_summary$coefficients[15,"Pr(>|t|)"],

region_renew_model_summary$coefficients[16,"Pr(>|t|)"],

region_renew_model_summary$coefficients[17,"Pr(>|t|)"],

region_renew_model_summary$coefficients[18,"Pr(>|t|)"])

) %>%

mutate(Renewable_Investment = round(Renewable_Investment, 2))

summary_renew_region_table %>%

kable(col.names = c("Region", "Renewable Investment per Year (million USD)", "p-value")) %>%

kable_styling(bootstrap_options = "striped",

full_width = FALSE,

latex_options = "HOLD_position")

| Region | Renewable Investment per Year (million USD) | p-value |

|---|---|---|

| North America | 24.76 | 0.6615318 |

| Africa | 288.09 | 0.0011902 |

| Asia | 234.07 | 0.0095686 |

| Central America and the Caribbean | 54.20 | 0.7128610 |

| Eurasia | 54.84 | 0.7173467 |

| Europe | 315.08 | 0.0003684 |

| Middle East | 22.61 | 0.9785519 |

| Oceania | 7.27 | 0.8400681 |

| South America | 255.03 | 0.0044462 |

The annual investment rate of each region according to this linear regression interaction model is available in the table. The regions with the two highest annual investment rates over time are Europe and Africa. Europe has widely been seen as a leader in renewable energy development and this is confirmed by the regression model. From IRENA’s raw data, Africa’s renewable energy investment has been particularly high in hydropower throughout various countries. The regions with the two lowest investment rates over time are Oceania and the Middle East. Oceania is primarily made up of island nations with low populations so large investments in these technologies can be challenging. The Middle East produces large quantities of the world’s fossil fuels so its lack of investment is not surprising.

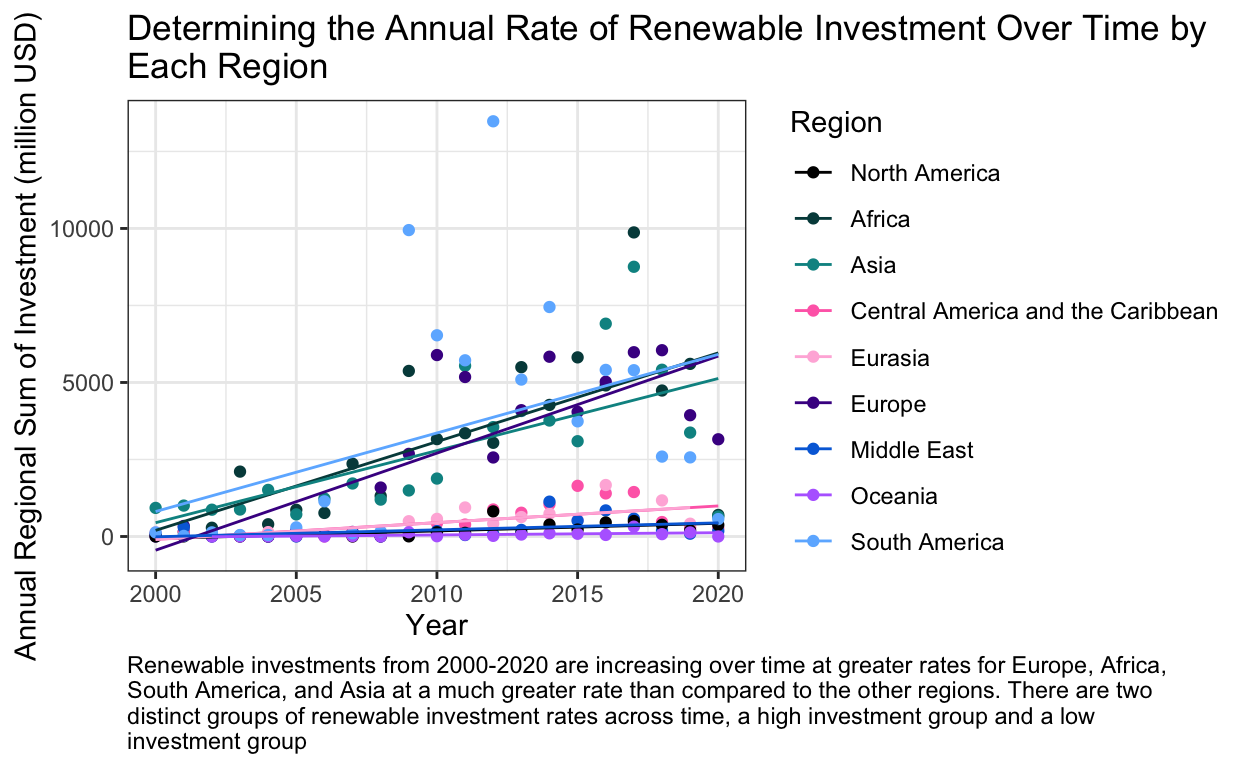

The only regions with p-values below a significance level of 0.05 are Africa, Asia, Europe, and South America. Therefore, for these regions we can reject the null hypothesis that there is no relationship for the region’s annual investment in renewables over time. Below is a plot that shows the regional model and the renewable investment rates over time separated by region.

Show code

# Plotting the regional model

regional_model_plot <- ggplot(data = region_renewable_fin,

aes(x = year, y = region_sum, color = region)) +

geom_point() +

geom_line(data = augment(region_model),

aes(y = .fitted)) +

scale_color_paletteer_d("colorBlindness::paletteMartin") +

labs(caption = "Renewable investments from 2000-2020 are increasing over time at greater rates for Europe, Africa,\nSouth America, and Asia at a much greater rate than compared to the other regions. There are two\ndistinct groups of renewable investment rates across time, a high investment group and a low\ninvestment group",

title = "Determining the Annual Rate of Renewable Investment Over Time by\nEach Region") +

xlab(label = "Year") +

ylab(label = "Annual Regional Sum of Investment (million USD)") +

theme_bw() +

theme(plot.caption = element_text(hjust = 0)) +

guides(color = guide_legend(title = "Region"))

regional_model_plot

The graphic clearly defines two different annual investment rate categories for global regions, a high investment rate group and a low investment rate group. The high rate investment group contains Europe, Africa,South America, and Asia. The low rate of investment group contains North America, Central America and the Caribbean, Eurasia, the Middle East, and Oceania.

Based on the regional interaction regression model above, I do the same for non-renewable energy investment and summarize both models into one output table.

Show code

# Make levels for regions with North America as first to compare our region to the rest of the world

region_non_renewable_fin$region <- factor(region_non_renewable_fin$region, levels = c("North America", "Africa", "Asia", "Central America and the Caribbean", "Eurasia", "Europe", "Middle East", "Oceania", "South America"))

# Make the regional investment model

region_non_renew_model <- lm(region_sum ~ year + region + region:year, data = region_non_renewable_fin)

region_non_renew_model_summary <- summary(region_non_renew_model)

Show code

summary_investment_region_table <- data.frame(summary_renew_region_table,

Non_Renewable_Investment = c(region_non_renew_model_summary$coefficients[2,"Estimate"],

region_non_renew_model_summary$coefficients[2,"Estimate"] + region_non_renew_model_summary$coefficients[11,"Estimate"],

region_non_renew_model_summary$coefficients[2,"Estimate"] + region_non_renew_model_summary$coefficients[12,"Estimate"],

region_non_renew_model_summary$coefficients[2,"Estimate"] + region_non_renew_model_summary$coefficients[13,"Estimate"],

region_non_renew_model_summary$coefficients[2,"Estimate"] + region_non_renew_model_summary$coefficients[14,"Estimate"],

region_non_renew_model_summary$coefficients[2,"Estimate"] + region_non_renew_model_summary$coefficients[15,"Estimate"],

region_non_renew_model_summary$coefficients[2,"Estimate"] + region_non_renew_model_summary$coefficients[16,"Estimate"],

region_non_renew_model_summary$coefficients[2,"Estimate"] + region_non_renew_model_summary$coefficients[17,"Estimate"],

region_non_renew_model_summary$coefficients[2,"Estimate"] + region_non_renew_model_summary$coefficients[18,"Estimate"]),

Non_Renewable_p_value = c(region_non_renew_model_summary$coefficients[2,"Pr(>|t|)"],

region_non_renew_model_summary$coefficients[11,"Pr(>|t|)"],

region_non_renew_model_summary$coefficients[12,"Pr(>|t|)"],

region_non_renew_model_summary$coefficients[13,"Pr(>|t|)"],

region_non_renew_model_summary$coefficients[14,"Pr(>|t|)"],

region_non_renew_model_summary$coefficients[15,"Pr(>|t|)"],

region_non_renew_model_summary$coefficients[16,"Pr(>|t|)"],

region_non_renew_model_summary$coefficients[17,"Pr(>|t|)"],

region_non_renew_model_summary$coefficients[18,"Pr(>|t|)"])) %>%

mutate(Non_Renewable_Investment = round(Non_Renewable_Investment, 2))

Show code

summary_investment_region_table %>%

kable(col.names = c("Region",

"Renewable Investment per Year (million USD)",

"Renewable p-value",

"Non-renewable Investment per Year (million USD)",

"Non-renewable p-value")) %>%

kable_styling(bootstrap_options = "striped",

full_width = FALSE,

latex_options = "HOLD_position") %>%

column_spec(column = 1, width = "1in") %>%

column_spec(column = 2, width = "1.3in") %>%

column_spec(column = 3, width = "1in") %>%

column_spec(column = 4, width = "1.3in") %>%

column_spec(column = 5, width = "1in")

| Region | Renewable Investment per Year (million USD) | Renewable p-value | Non-renewable Investment per Year (million USD) | Non-renewable p-value |

|---|---|---|---|---|

| North America | 24.76 | 0.6615318 | 9.97 | 0.9456139 |

| Africa | 288.09 | 0.0011902 | 155.40 | 0.4086434 |

| Asia | 234.07 | 0.0095686 | 254.85 | 0.1649952 |

| Central America and the Caribbean | 54.20 | 0.7128610 | 6.05 | 0.9829376 |

| Eurasia | 54.84 | 0.7173467 | 96.44 | 0.6229642 |

| Europe | 315.08 | 0.0003684 | 81.26 | 0.6852117 |

| Middle East | 22.61 | 0.9785519 | 35.86 | 0.8897374 |

| Oceania | 7.27 | 0.8400681 | -0.56 | 0.9573164 |

| South America | 255.03 | 0.0044462 | 171.52 | 0.3588261 |

The above table allows for the comparison of the annual rates of renewable and non-renewable investment over time by each region and their corresponding p-values. The non-renewable regression model has no investment rate p-value below a significance level of 0.05. Therefore no non-renewable investment rate can be considered statistically significant. For renewables, the investment rates for Africa, Asia, Europe, and South America can be considered statistically significant as their p-values are below a significance level of 0.05.

Some interesting regional insights from this table however show that South America, Africa, and Asia are investing heavily in renewable and non-renewable energies over time. These regions have economies that are developing rapidly compared to other regions of the world and it is evident in these investment trends. According to the regression models, Europe has been investing the most in renewables compared to other regions year-over-year but not in non-renewables. However, as mentioned earlier no non-renewable investment rates can be considered statistically significant so it is difficult to comment on non-renewable trends as they may not exist.

To summarize, the world as a whole is investing more in renewable energy projects each year. However, the world is also investing more in non-renewable energy projects each year. By region, only the annual investment rates for Africa, Asia, Europe, and South America can be considered statistically significant as their p-values are below a significance level of 0.05. For other regions, the regression model fails to reject the null hypothesis that there is no relationship with investment in renewable projects over time.

Next Steps

This blog post and regression analysis is by no means a comprehensive look at financial investments over time by each region. It provides quick insights into how some regions are investing in renewable technologies at a greater rate over time compared to other regions. There are many factors that can affect a regions total annual investment into renewable energy.

To dive further into the questions put forward earlier, it would be interesting to normalize investment rates with the GDP of each region. One could also compare specific countries and the affect of the type of government on renewable investment energies. Regional trends can also be greatly affected by a single country’s influence so breaking down this analysis by country would provide further insights. Another option would be to compare the investment rates of countries with rapidly developing economies compared to those who have developed economies to see if there are any relevant trends. As noted before, there is a visual trend in the graphs that much greater investment occurred after the 2008 recession. A deeper analysis could be done to see if this observation is statistical significant and to try and figure out what has caused it.

References

IRENA, & CPI. (n.d.-a). Global Landscape of Renewable Energy Finance 2020. 88.

IRENA, & CPI. (n.d.-b). Global Landscape of Renewable Energy Finance 2020: Methodology. 16.

Ritchie, H., & Roser, M. (2020). Energy. Our World in Data. https://ourworldindata.org/renewable-energy

Roser, M. (n.d.). Why did renewables become so cheap so fast? Our World in Data. https://ourworldindata.org/cheap-renewables-growth